Social Security is a federal benefits program that provides financial assistance to eligible individuals, including retirees, disabled persons, and survivors of deceased workers. It was established in 1935 through the Social Security Act, which aimed to create a safety net for Americans in their retirement years or in cases of unforeseen financial hardship. Today, Social Security is one of the most critical sources of retirement income for millions of Americans.

Social Security serves multiple essential functions:

The program is administered by the Social Security Administration (SSA), which oversees the collection of payroll taxes and the distribution of benefits to eligible individuals.

Individuals must meet specific eligibility criteria based on work history, age, and certain life circumstances to qualify for Social Security benefits.

Social Security benefits are determined based on a worker’s average indexed monthly earnings (AIME) and the age at which they claim benefits. The SSA uses a complex formula to calculate individual benefits, but the key factors include work history and claiming age.

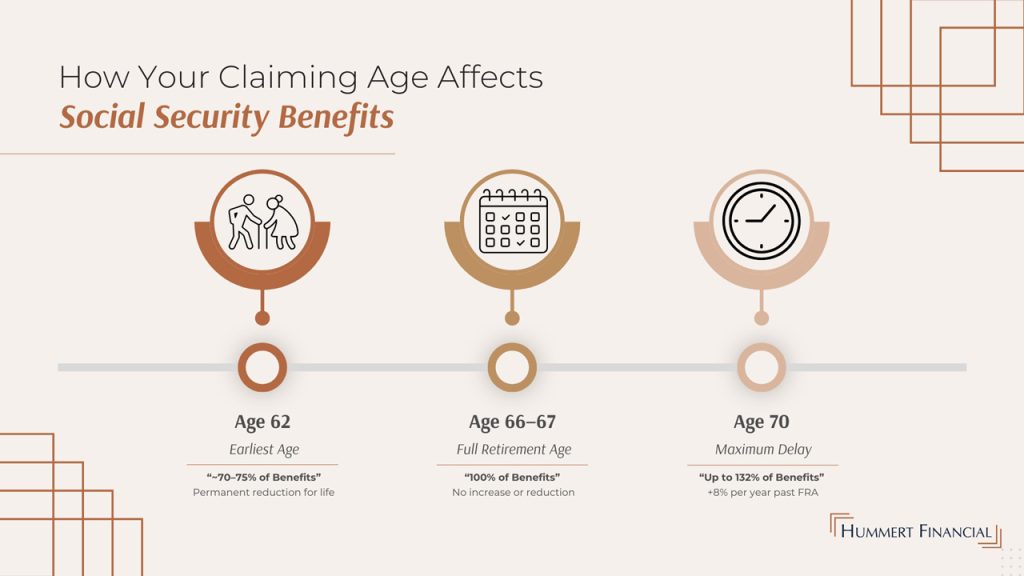

The age at which you choose to claim Social Security benefits has a lasting impact on your monthly payments. Claiming before full retirement age results in a permanent reduction in benefits, while delaying beyond FRA can increase benefits by 8% per year until age 70, maximizing lifetime payouts.

| Claiming Age | Benefit Amount |

|---|---|

| 62 (Earliest) | Reduced Benefits (~70-75%) |

| FRA (66-67) | Full Benefits (100%) |

| 70 | Maximum Benefits (Up to 132%) |

There are several ways to apply for Social Security benefits. The SSA offers both online and in-person options.

While Social Security is often the primary source of retirement income, one should consider supplementing it with other financial strategies.

While Social Security provides a foundation for retirement income, it is rarely enough to cover all expenses. Retirees should consider additional income sources to help create a more well-rounded financial picture. The following options may help supplement Social Security:

Social Security benefits are taxed based on total income, and up to 85% of benefits are potentially subject to federal taxes.

Strategic withdrawals from retirement accounts, such as IRAs and 401(k)s, may help manage taxable income and reduce overall tax liabilities. Additionally, state tax laws vary—some states tax Social Security benefits, while others do not. Because tax implications differ based on individual circumstances, it’s essential to consult a qualified tax professional or financial advisor who can provide guidance tailored to your situation.

When planning for retirement, it’s important to consider the long-term outlook for Social Security. Future retirees should be aware that potential changes to Social Security funding could impact their benefits.

Possible reforms include raising the retirement age, increasing payroll taxes, or modifying benefit structures. Given this uncertainty, diversifying retirement income sources—such as employer-sponsored plans, IRAs, pensions, and personal investments—can help mitigate risk and reduce reliance on Social Security alone.

You can claim Social Security benefits as early as age 62, but your monthly payments will be permanently reduced compared to waiting until Full Retirement Age (FRA).

You can check your estimated Social Security benefits by creating an account on the Social Security Administration website and using their benefits calculator.

Yes, you can work while receiving Social Security, but if you claim before FRA, your benefits may be reduced if your earnings exceed the annual limit. Once you reach FRA, your benefits will no longer be reduced based on earnings.

Yes. Social Security benefits are adjusted annually through Cost-of-Living Adjustments (COLA) to help keep up with inflation. The adjustment varies each year based on economic conditions.

Each year you delay claiming Social Security past your FRA (up to age 70), your benefits increase by 8% per year through delayed retirement credits.

Want to make smarter, more confident decisions about when and how to claim Social Security? Download our free guide to avoid common mistakes and maximize your benefits.

Check the background of your financial professional on FINRA's BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

The LPL Financial Registered Representatives associated with this site may only discuss and/or transact securities business with residents of the following states: AZ,CA,CO,FL,GA,IA,IL,IN,KS,KY,MO,PA,UT,WI.

Securities and Advisory services offered through LPL Financial, a Registered Investment Advisor. Member FINRA & SIPC.

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.